On October 17, an analytical article on the food retail from the editor Alla Dubrovik-Rokhovaya was published in the economic section of the 'Den' (Day) newspaper.

The material examines the main problems Ukrainian and European markets have encountered while establishing online food ordering practices, as well as cases of well-known companies worldwide. Alla cited Zakaz.Ua - a project that Chernovetskyi Investment Group has fully invested in - as an example of a successful Ukrainian retail business online in this segment. At the moment, CIG investment portfolio also comprises such food retail startups as Eda.Ua (part of Foodout Group) and InnerChef India.

Read the full article below or on the website (available in Russian only):

https://day.kyiv.ua/ru/article/ekonomika/budushche...

The food retail market and the operational processes of the retailers themselves in Ukraine can be considered obsolete. It is in retail that the interaction of customers with the supermarkets has not changed for decades (not taking into account the marketing side). Earlier, the process of products purchasing implied direct interaction with the seller, whereas in 1916 this concept was changed towards self-service stores (see Clarence Sanders stores), where the consumers themselves chose products based on their preferences. Since then, this concept has not evolved: the consumer has to come to the store and select the products they need, stand in a line and carry what they bought home, driving through traffic jams. . However, the modern pace of life requires time optimization, and the retailer needs better interaction with each client. It takes a permanent improvement of business processes and seeking the increase of potential customers number to be a competitive retailer. And right now, the search for the new points of convergence with the client is one of the key metrics of sustainable business development.

The relatively low marginality of the retail business encourages the constant search for improvement and optimization of business processes. The growing digitalization of society prompts large retail chains to look for these points of convergence via the Internet. For example, in 1999, a company was created in the USA, FreshDirect, that delivered fresh vegetables and fruits to customers who placed their orders online. A similar “early understanding” of the online presence importance was shown by the Utkonos company, created in Russia in 2000 and moved online completely in 2011 due to the strategic business optimization. According to estimates by consulting and marketing agencies, the number of Europeans who have ever ordered products online is about 24% among Internet users. The percentage may seem insignificant, but just because people in Europe do not order products online en masse does not mean that they do not want to. This is evidenced by the fact that many of them like the idea of not wasting time going to the store and spending ages walking among product shelves, as the Nielsen report states. The convenience of buying products online is attractive out of the timesaving concerns.

Ukrainian domestic market is keeping up with the European trend. For example, there has been a company named Zakaz.ua for a while, which makes its customers’ lives easier and also helps to increase the turnover of such retail chains as Auchan, Novus, Metro, Fozzy. In general, in Ukraine, the food delivery market is growing annually by more than 30%. At the same time, it can be noted that the market is not saturated, and the demand, both qualitative and quantitative, will continue to grow.

The main fundamental factors of growth in these services are:

• online penetration - the more Internet users there are, the greater potential customers number there will be;

• the remoteness of stores - in general, large retail stores with a big variety of goods aren’t located near the house, and it is not always convenient for consumers to get there; particularly, such a driver is vital in the USA, where large malls are located outside the city. However, this also applies to Ukraine: earlier, only people living within walking distance of the network’s store were likely to become its customers but now it is easy for almost anyone to purchase from it. ;

• saving time - a factor that basically determines the need for such services in Ukraine. The shortage and rational use of time is especially acute among the inhabitants of million-plus cities;

• huge and heavy delivery - people don’t always have the opportunity to use a car and consumers with a large volume of goods experience inconvenience delivering it on their own, for example, mothers with children, party organizers, etc.

In simple words, product delivery services seem to increase convenience for the consumer choosing products. Since consumers buy high-quality products, choose from a wide range and, most importantly, pay the price that is identical to the one an offline supermarket offers. In addition to specialized companies that offer services of assembling and delivering products, retailer chains themselves are trying to create their own online trading. An example would be the activity of the European retail giants such as English Tesco and French Carrefour. However, there is a significant difference between two mentioned businesses and processes, since a retailer essentially gains income from the store (shelf) area, whereas assembly, packaging, delivery is a complex logistics business that differs fundamentally from the food retail.

To date, not all the potential consumers use product delivery services. Despite the fact that such companies as Instacart (USA), Ocado (Britain) or Zakaz (Ukraine) solve all the above-mentioned problems, there are obstacles that currently cannot be overcome. In particular, Nielsen conducted a survey of consumers, and found that the main obstacle to using food delivery services was the impossibility of a search/examination of the desired products beforehand: 69% of customers stated that they preferred to choose products by themselves, which is mainly reflected when choosing fruits and vegetables. However, the delivery services are eager to address consumers’ issues, and introduce loyalty programs and take on additional guarantees for the quality and return of goods.

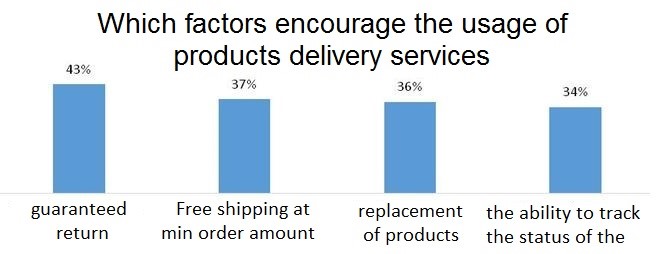

(from left to right: guaranteed refund; free delivery with a minimum order amount; products replacement; availability of the order status tracking)

In general, there is an upward trend of the retailers’ increasing focus on the online sales in the Ukrainian market. All retail giants fully support this sales channel by implementing appropriate IT solutions.

The formats don’t change often in the retail segment but when they do, it leads to big changes in the classic business. It is important to note that in emerging markets, there is a catch-up development trend and the formation of an online products delivery segment. Today, This segment is formed both by the demand side (consumers) and by the supply side (retailers), so the competition is still low today. Nevertheless, it is worth noting that only those players who will manage to form a working online model will be able to gain leading positions in the retail food business.

The growing dynamics of food tech market certainly attracts more and more investors. Due to the limited statistics, the number and size of transactions in Ukraine are quite difficult to track but one can definitely mention the multimillion-dollar investment from the Chernovetskyi Investment Group in Zakaz.ua, EDA.UA (part of the Foodout Group). More than $3 million was invested in these two Ukrainian projects alone by CIG, and due to the development of companies and future rounds, it is definitely just the beginning of the big stories of Ukrainian entrepreneurship. The Poster project team (a system for the automation of cafes and restaurants) at the beginning of its long journey has also attracted seed investments from 908.vc; the Crew Service company delivering ready-made meals from restaurants in 2012 attracted funds from a group of Ukrainian and foreign investors. The same applies to the number of other food tech startups.

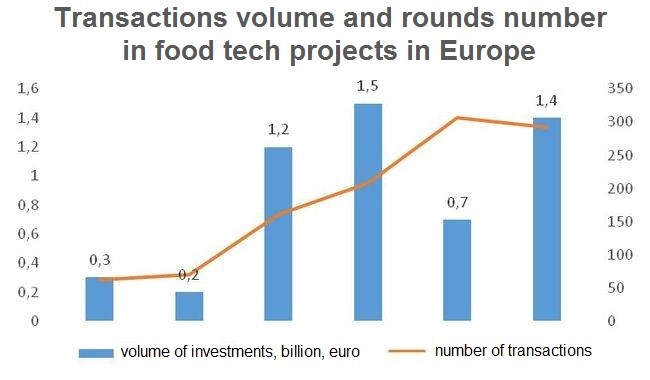

The European market can boast higher rates, so since 2012, more than 5,3 billion euros have been invested in food tech projects. The number of rounds in 2017 reached 300, with no more than a dozen transactions in Ukraine.

(from left to right: investments volume, bln euro; transactions number)

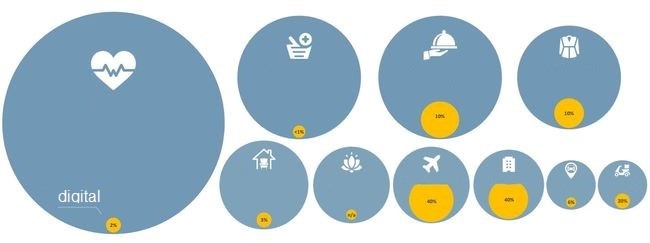

The graph below clearly shows that the most developed segments with a 40% level of online penetration (booking and payment) are flights and hotels. They are followed by the fairly common delivery service (20%), shopping for clothes and shoes (10%) and the bars and restaurants segment (10%).

(from left to right: health care 2 tn euro, Internet penetration 2%; foodstuffs 500 bn euro <1%; restaurants and bars 500 bn euro, 10%; fashion 300 bn euro, 10%; household goods, 200 bn euro, 3%; wellness 100 bn euro, n/a; flights 100 bn euro, 40%; hotels, 90 bn euro, 40%; taxi 30 bn euro, 6%; delivery 30 bn euro, 20%)

Even in Europe, the online food segment is about 1%, which indicates the huge growth prospects for even such a developed market as regards to the number of solvent Internet users. So according to the American research company Forrester, 4.5% of all product purchases in Europe will be made via the Internet by 2022, and according to the UBS investment bank, this share will be about 3.3% in Russia. We will strive for the Ukrainian market to show a higher growth rate and become an investment-attractive haven for the development of food tech and other Internet projects.